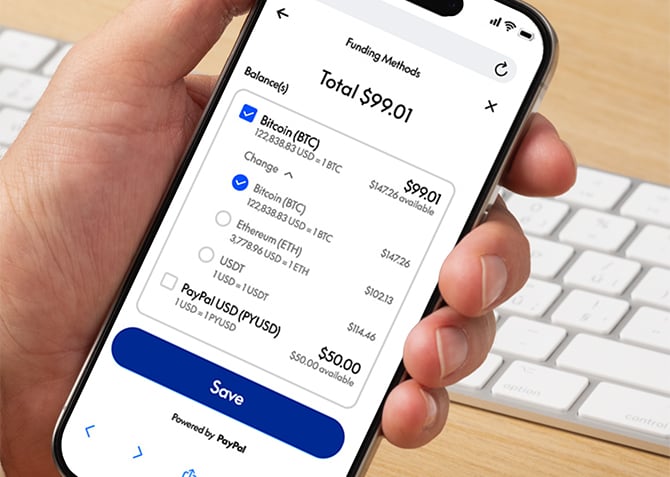

PayPal has rolled out a new “Pay with Crypto” feature that allows people to use Bitcoin, Ethereum, and other major cryptocurrencies to pay for goods and services directly through their PayPal accounts. The company is touting it as a way to simplify global transactions while cutting conversion and transaction fees by up to 90%.

As someone who pays contributors all over the world, I know how much fees can eat into profits. Whether it’s currency conversion costs or platform processing fees, it all adds up. So, I understand the appeal of Pay with Crypto: no middleman banks, no international wire fees, and instant transactions that bypass traditional systems. On paper, it sounds like a win for freelancers, small businesses, and anyone sending money across borders.

But here’s the catch: crypto is still too volatile for most people to treat it like cash. The value of Bitcoin or Ethereum can swing dramatically in a single day. Even if PayPal automatically converts the crypto to local currency for merchants (which it does), the average person holding crypto faces real risk. It’s hard to budget or plan when your “money” could be worth 10% less – or more – overnight. That kind of unpredictability makes it tough to see crypto becoming a mainstream payment method anytime soon.

Read more: Track Your Wallet Without Losing a Card Slot

Still, PayPal’s move is significant. It normalizes crypto in everyday transactions and makes it easier to spend digital currencies without navigating clunky wallets or exchanges. If you already hold crypto, this is a convenient, low-friction way to use it. For everyone else, though, it’s worth watching – but probably not worth jumping in just yet unless you’re comfortable with the risk.

Read next: How Starlink Is Powering Scams That Target Americans

[Image credit: Screenshots via PayPal, phone mockup via Canva]